08-01-2026

SDM met the Ambassadors of Kazakhstan and Slovenia...

SDM – Sociedade de Desenvolvimento da Madeira welcomed, during the month of December, the visit...

08-01-2026

SDM met the Ambassadors of Kazakhstan and Slovenia...

SDM – Sociedade de Desenvolvimento da Madeira welcomed, during the month of December, the visit...

05-01-2026

IBCM Presented at the 11th Ibero-American Business Meeting...

On November 18th, SDM participated at the 11th Ibero-American Business Meeting, organized by the....

05-01-2026

IBCM Presented at the 11th Ibero-American Business Meeting...

On November 18th, SDM participated at the 11th Ibero-American Business Meeting, organized by the....

26-11-2025

Madeira’s IBC Regime Extended Until 2033

On 20th November 2025, the Portuguese Parliament approved the extension of the preferential tax r...

26-11-2025

Madeira’s IBC Regime Extended Until 2033

On 20th November 2025, the Portuguese Parliament approved the extension of the preferential tax r...

11-11-2025

Madeira reinforces its strategic role in the European economy...

President of SDM highlights the contribution of the Madeira International Business Centre at a Eu...

11-11-2025

Madeira reinforces its strategic role in the European economy...

President of SDM highlights the contribution of the Madeira International Business Centre at a Eu...

07-11-2025

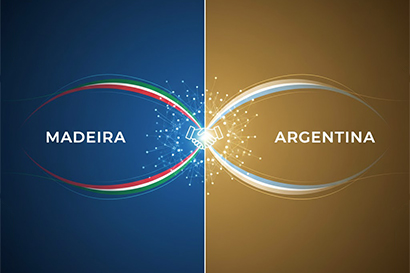

Argentine Ambassador to Portugal meets with SDM to learn about the Madeira's IBC...

The Sociedade de Desenvolvimento da Madeira (SDM) welcomed on October 31st the visit of the Ambas...

07-11-2025

Argentine Ambassador to Portugal meets with SDM to learn about the Madeira's IBC...

The Sociedade de Desenvolvimento da Madeira (SDM) welcomed on October 31st the visit of the Ambas...

29-09-2025

CEO of Madeira’s IBC Company Appointed European Cybersecurity Ambassador...

Thomas Berndorfer, CEO of Connecting Software, a company licensed in the Madeira International Bu...

29-09-2025

CEO of Madeira’s IBC Company Appointed European Cybersecurity Ambassador...

Thomas Berndorfer, CEO of Connecting Software, a company licensed in the Madeira International Bu...

On the 8th of November 2010, the Portuguese Ministry of Finance and Public Administration announced that negotiations towards the conclusion of a Double Taxation Agreement between the Portuguese Republic and the Angolan Government have been initiated.

Negotiations are still in a very early stage. Though, once approved, this Agreement will be a key instrument to avoid double taxation and is likely to promote internationalization and closer business relations between companies of both countries.

In fact, this Double Taxation Agreement may even become the first bilateral instrument of this kind in force in Angola, which, given the relevance of this region both to domestic and foreign investors, can determine the choice of Portugal as an efficient jurisdiction for investments in this region.

In this context, investments in Angola through the incorporation of a company within Madeira’s IBC will become even more attractive both to domestic and foreign investors wishing to invest in this country, since, besides the advantages of the IBC regime, they might potentially benefit from a relevant instrument of tax relief.