08-01-2026

SDM met the Ambassadors of Kazakhstan and Slovenia...

SDM – Sociedade de Desenvolvimento da Madeira welcomed, during the month of December, the visit...

08-01-2026

SDM met the Ambassadors of Kazakhstan and Slovenia...

SDM – Sociedade de Desenvolvimento da Madeira welcomed, during the month of December, the visit...

05-01-2026

IBCM Presented at the 11th Ibero-American Business Meeting...

On November 18th, SDM participated at the 11th Ibero-American Business Meeting, organized by the....

05-01-2026

IBCM Presented at the 11th Ibero-American Business Meeting...

On November 18th, SDM participated at the 11th Ibero-American Business Meeting, organized by the....

26-11-2025

Madeira’s IBC Regime Extended Until 2033

On 20th November 2025, the Portuguese Parliament approved the extension of the preferential tax r...

26-11-2025

Madeira’s IBC Regime Extended Until 2033

On 20th November 2025, the Portuguese Parliament approved the extension of the preferential tax r...

11-11-2025

Madeira reinforces its strategic role in the European economy...

President of SDM highlights the contribution of the Madeira International Business Centre at a Eu...

11-11-2025

Madeira reinforces its strategic role in the European economy...

President of SDM highlights the contribution of the Madeira International Business Centre at a Eu...

07-11-2025

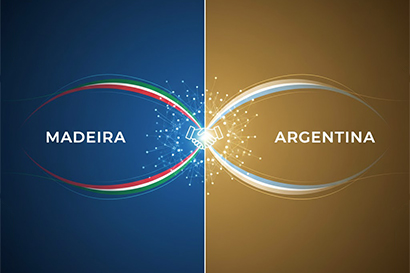

Argentine Ambassador to Portugal meets with SDM to learn about the Madeira's IBC...

The Sociedade de Desenvolvimento da Madeira (SDM) welcomed on October 31st the visit of the Ambas...

07-11-2025

Argentine Ambassador to Portugal meets with SDM to learn about the Madeira's IBC...

The Sociedade de Desenvolvimento da Madeira (SDM) welcomed on October 31st the visit of the Ambas...

29-09-2025

CEO of Madeira’s IBC Company Appointed European Cybersecurity Ambassador...

Thomas Berndorfer, CEO of Connecting Software, a company licensed in the Madeira International Bu...

29-09-2025

CEO of Madeira’s IBC Company Appointed European Cybersecurity Ambassador...

Thomas Berndorfer, CEO of Connecting Software, a company licensed in the Madeira International Bu...

As a result of the conclusions of the recent G20 summit, which was held last April in London, Madeira’s International Business Centre has consolidated its position as a transparent and well regulated jurisdiction, fully integrated in the new architecture of the world financial order.

Madeira’s International Business Centre is a Portuguese jurisdiction of international vocation, formally approved by the European Commission as a State Aid Regime and created with the objective of providing adequate conditions for the development and diversification of a small outermost island economy such as Madeira’s.

The unanimous topic of attention in the G20 summit has been the need to distinguish the group of countries that have always cooperated and followed the rules of transparency and exchange of information, where Portugal has always been included, from those who do not cooperate on these matters and hence require particular attention from international organizations and tax authorities.

As a result of such analysis, Portugal has been included in the OECD white list, thus reconfirming very clearly the position of Madeira’s International Business Centre as a legitimate and credible jurisdiction, at a time when world leaders seek to re-establish the global confidence on the international financial system.

The recognition of Madeira’s IBC position, however, does not come as a surprise, since this jurisdiction has always been fully submitted to the Portuguese and E.U. legal order and has never been classified as an offshore centre or as a tax haven by international organizations such as the OECD or the European Union.

The stability of Madeira’s IBC tax regime, which shall remain unaltered until the end of 2020, and the confirmation of its transparency and strict compliance of international rules by the most relevant international authorities as far as fiscal regulation and supervision are concerned, provides national and international investors operating through Madeira’s IBC a high level of security and efficiency, in addition to the unique package of tax incentives that is applicable to a wide range of activities.