08-01-2026

SDM met the Ambassadors of Kazakhstan and Slovenia...

SDM – Sociedade de Desenvolvimento da Madeira welcomed, during the month of December, the visit...

08-01-2026

SDM met the Ambassadors of Kazakhstan and Slovenia...

SDM – Sociedade de Desenvolvimento da Madeira welcomed, during the month of December, the visit...

05-01-2026

IBCM Presented at the 11th Ibero-American Business Meeting...

On November 18th, SDM participated at the 11th Ibero-American Business Meeting, organized by the....

05-01-2026

IBCM Presented at the 11th Ibero-American Business Meeting...

On November 18th, SDM participated at the 11th Ibero-American Business Meeting, organized by the....

26-11-2025

Madeira’s IBC Regime Extended Until 2033

On 20th November 2025, the Portuguese Parliament approved the extension of the preferential tax r...

26-11-2025

Madeira’s IBC Regime Extended Until 2033

On 20th November 2025, the Portuguese Parliament approved the extension of the preferential tax r...

11-11-2025

Madeira reinforces its strategic role in the European economy...

President of SDM highlights the contribution of the Madeira International Business Centre at a Eu...

11-11-2025

Madeira reinforces its strategic role in the European economy...

President of SDM highlights the contribution of the Madeira International Business Centre at a Eu...

07-11-2025

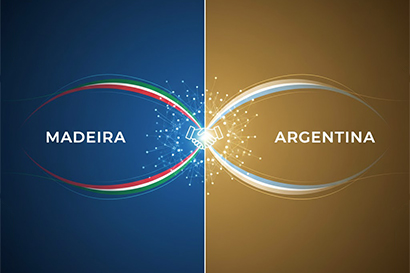

Argentine Ambassador to Portugal meets with SDM to learn about the Madeira's IBC...

The Sociedade de Desenvolvimento da Madeira (SDM) welcomed on October 31st the visit of the Ambas...

07-11-2025

Argentine Ambassador to Portugal meets with SDM to learn about the Madeira's IBC...

The Sociedade de Desenvolvimento da Madeira (SDM) welcomed on October 31st the visit of the Ambas...

29-09-2025

CEO of Madeira’s IBC Company Appointed European Cybersecurity Ambassador...

Thomas Berndorfer, CEO of Connecting Software, a company licensed in the Madeira International Bu...

29-09-2025

CEO of Madeira’s IBC Company Appointed European Cybersecurity Ambassador...

Thomas Berndorfer, CEO of Connecting Software, a company licensed in the Madeira International Bu...

The Double Taxation Agreement for the avoidance of double taxation and prevention of fiscal evasion concluded between Portugal and Uruguay, signed at Estoril in November 2009, was recently published in the Portuguese official gazette.

This agreement, which closely follows the OECD model Convention, is an important tool to be considered both by individuals and companies moving forward with their international tax planning strategies.

The agreement applies to taxes on income imposed on behalf of a Contracting State, which, in case of Uruguay, are the tax on business income, the personal income tax, the non-resident income tax, the tax for social security assistance and the capital tax; and, in Portugal, personal income tax (IRS), corporate income tax (IRC) and local surtax on corporate income tax (derrama).

The agreement provides that dividends, interest and royalties paid or arising from a company, which is a resident of a Contracting State to a resident of the other Contracting State, may be taxed in that other State. However, such dividends, interest or royalties may also be taxed in the Contracting State in which it arises and according to their internal laws, but if the recipient is the beneficial owner of the dividends, interest, or royalties, the tax so charged shall not exceed in the case of dividends 5 % of the gross amount of the dividends if the beneficial owner is a company that holds directly at least 25 % of the capital of the company paying the dividends, or 10 % of the gross amount of the dividends in all other cases, and, in any case, 10% of the gross amount of interest or royalties.

In what concerns capital gains taxation, the agreement provides that capital gains from personal property (even when located in the other Contracting State) from property that forms part of the assets of a permanent establishment or fixed base that a company from one of the contracting states has in another Contracting State and gains from the alienation of shares, or of a comparable interest deriving more than 50 % of their value directly or indirectly from immovable property situated in the other Contracting State, may be taxed in that other State.

On the other hand, gains from the alienation of ships or aircraft operated in international traffic or from movable property pertaining to the operation of such ships or aircraft and other gains not specifically provided on article 13.º of the agreement, shall be taxable only in the Contracting State in which the place of effective management of the enterprise is located in the case of ships and aircrafts operated in international traffic, and in the contracting State of which the alienator is a resident in the case of gains not specifically provided.

The elimination of double taxation in Portugal should occur in the following way: