08-01-2026

SDM met the Ambassadors of Kazakhstan and Slovenia...

SDM – Sociedade de Desenvolvimento da Madeira welcomed, during the month of December, the visit...

08-01-2026

SDM met the Ambassadors of Kazakhstan and Slovenia...

SDM – Sociedade de Desenvolvimento da Madeira welcomed, during the month of December, the visit...

05-01-2026

IBCM Presented at the 11th Ibero-American Business Meeting...

On November 18th, SDM participated at the 11th Ibero-American Business Meeting, organized by the....

05-01-2026

IBCM Presented at the 11th Ibero-American Business Meeting...

On November 18th, SDM participated at the 11th Ibero-American Business Meeting, organized by the....

26-11-2025

Madeira’s IBC Regime Extended Until 2033

On 20th November 2025, the Portuguese Parliament approved the extension of the preferential tax r...

26-11-2025

Madeira’s IBC Regime Extended Until 2033

On 20th November 2025, the Portuguese Parliament approved the extension of the preferential tax r...

11-11-2025

Madeira reinforces its strategic role in the European economy...

President of SDM highlights the contribution of the Madeira International Business Centre at a Eu...

11-11-2025

Madeira reinforces its strategic role in the European economy...

President of SDM highlights the contribution of the Madeira International Business Centre at a Eu...

07-11-2025

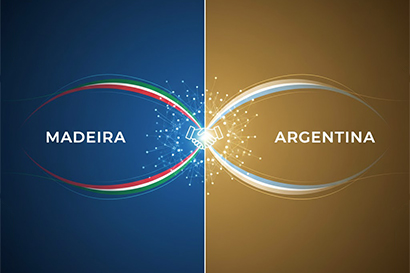

Argentine Ambassador to Portugal meets with SDM to learn about the Madeira's IBC...

The Sociedade de Desenvolvimento da Madeira (SDM) welcomed on October 31st the visit of the Ambas...

07-11-2025

Argentine Ambassador to Portugal meets with SDM to learn about the Madeira's IBC...

The Sociedade de Desenvolvimento da Madeira (SDM) welcomed on October 31st the visit of the Ambas...

29-09-2025

CEO of Madeira’s IBC Company Appointed European Cybersecurity Ambassador...

Thomas Berndorfer, CEO of Connecting Software, a company licensed in the Madeira International Bu...

29-09-2025

CEO of Madeira’s IBC Company Appointed European Cybersecurity Ambassador...

Thomas Berndorfer, CEO of Connecting Software, a company licensed in the Madeira International Bu...

Amongst these are the General Block Exemption Regulation (GBER) in which the IBC of Madeira is included and which has been extended until the end of 2023.

This is on the basis that the Commission has concluded that in such turbulent times it is easier to extend the current law rather than incur the disruption of potentially significant changes at the end of this year, when many exemptions were otherwise due to expire.

According to the EC, this is "In order to provide predictability and legal certainty, whilst preparing for a possible future update of the State aid rules (...)".

The extension of the preferential tax regime of the IBC of Madeira must now be reflected in the internal Portuguese legislation, namely through the amendment of the Statute of Fiscal Benefits by the Portuguese Government.