08-01-2026

SDM met the Ambassadors of Kazakhstan and Slovenia...

SDM – Sociedade de Desenvolvimento da Madeira welcomed, during the month of December, the visit...

08-01-2026

SDM met the Ambassadors of Kazakhstan and Slovenia...

SDM – Sociedade de Desenvolvimento da Madeira welcomed, during the month of December, the visit...

05-01-2026

IBCM Presented at the 11th Ibero-American Business Meeting...

On November 18th, SDM participated at the 11th Ibero-American Business Meeting, organized by the....

05-01-2026

IBCM Presented at the 11th Ibero-American Business Meeting...

On November 18th, SDM participated at the 11th Ibero-American Business Meeting, organized by the....

26-11-2025

Madeira’s IBC Regime Extended Until 2033

On 20th November 2025, the Portuguese Parliament approved the extension of the preferential tax r...

26-11-2025

Madeira’s IBC Regime Extended Until 2033

On 20th November 2025, the Portuguese Parliament approved the extension of the preferential tax r...

11-11-2025

Madeira reinforces its strategic role in the European economy...

President of SDM highlights the contribution of the Madeira International Business Centre at a Eu...

11-11-2025

Madeira reinforces its strategic role in the European economy...

President of SDM highlights the contribution of the Madeira International Business Centre at a Eu...

07-11-2025

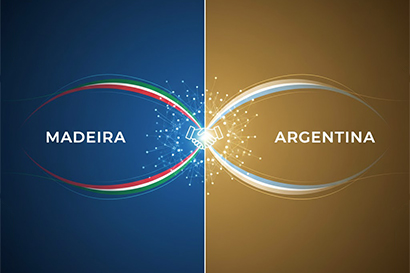

Argentine Ambassador to Portugal meets with SDM to learn about the Madeira's IBC...

The Sociedade de Desenvolvimento da Madeira (SDM) welcomed on October 31st the visit of the Ambas...

07-11-2025

Argentine Ambassador to Portugal meets with SDM to learn about the Madeira's IBC...

The Sociedade de Desenvolvimento da Madeira (SDM) welcomed on October 31st the visit of the Ambas...

29-09-2025

CEO of Madeira’s IBC Company Appointed European Cybersecurity Ambassador...

Thomas Berndorfer, CEO of Connecting Software, a company licensed in the Madeira International Bu...

29-09-2025

CEO of Madeira’s IBC Company Appointed European Cybersecurity Ambassador...

Thomas Berndorfer, CEO of Connecting Software, a company licensed in the Madeira International Bu...

This indicator confirms an increase in the number of new companies in the IBC, largely due to the most recent decisions taken by the European Comission.

One of the EC’s decisions was to increase by 36,7% the ceilings up to which the taxable profit of companies licensed to operate in the International Business Centre of Madeira may enjoy a reduced corporate tax rate of 5%, one of the lowest in the European Union. The second decision extended the authorization of new companies in the IBC until the 30th of June, 2014, confirming the preparation of the negotiations concerning the IV Regime of the IBCM, whose benefits will be extended beyond 2020.

Both measures clearly contributed to enhance the credibility and competitiveness of the International Business Centre of Madeira.

The two main drivers of the growth of Madeira’s IBC are the International Services Sector and the International Shipping Register (MAR).

These two business sectors are attracting investors from various markets. In fact, the IBC of Madeira continues to ensure investment from traditional European markets, as in the case of France, Italy and Spain. Nevertheless, investors from emerging markets, such as Russia and South Africa, are also establishing companies in the IBC of Madeira.

As far as the Shiping Register is concerned, the German market is the one which has shown greater interest in MAR.

Madeira’s International Business Centre is also experiencing an increasing number of Portuguese companies, in particular exporters and companies who are expanding their international operations.

During 2014, S.D.M. is conducting a dymanic promotional plan, with missions to over 14 countries, from different continents, with the aim of attracting further investment into Madeira.