Labour Regulations

The working week includes a maximum of 40 hours with Sunday being the day of rest. Employees are entitled to 22 working days of vacation per year, plus 10 days statutory holidays, and to sick leave and maternity leave. If the employee starts to work in the first half of the calendar year, he will be entitled to a minimum vacation period of 12 working days during that year.

Overtime is payable at the rate of 125% for the first hour and 137,5% thereafter. Overtime worked during rest days is payable at the rate of 150%. Salaries are paid on a monthly basis 14 months per year (holidays and Christmas bonuses included).

The law allows short-term contracts, with a minimum period of 6 months, renewable at the employer’s option, up to a limited period of 3 years, after which the employee is either granted a permanent contract or is dismissed.

Local recruitment

Placing an advertisement in local and national newspapers is a very common procedure, as well as resorting to the local employment centre or a recruitment agency. S.D.M. – Sociedade de Desenvolvimento da Madeira, S.A. has created a database containing the CV’s of applicants who seek job opportunities within the companies operating under Madeira's IBC. Companies may also use this database and a dedicated section of this website to advertise their recruitment needs.

Madeira’s University, as well as other local technical schools, are a good source of skilled professionals. It is also possible to recruit from a large pool of Madeirans studying in Portuguese universities or working abroad.

Foreign staff

Portugal abides by Article 9º of the Convention for the Application of the Schengen Agreement, namely regarding the regime of the concession of visas. The working visa will allow the entrance in Portuguese territory of foreign citizens (from non EU or European Economic Area (EEA) countries or Switzerland), for the undertaking of their professional activities for a maximum of three years (allowing for multiple entrances). Visas should be applied for from a Portuguese consulate or embassy in the country of residence. The applicant will have to present a valid working contract in Portugal and will be subject to an interview at the Portuguese Consulate.

All citizens from the EU, EEA and Switzerland are allowed to enter, remain and live in Portugal, up to three months, without formalities other than holding a valid passport or identity card. Relatives accompanying such citizens, irrespective of their nationality, are also allowed to enter, remain and live in Portuguese territory. If the three months period is exceeded, such citizens must proceed with a registration at the SEF- Foreigners and Frontiers Services, to formalize the right to reside in Portugal. Relatives, of EU or non-EU citizenship, are also required to register at the SEF.

Personal Income Tax and Social Security Taxes

Companies are required to withhold personal income tax and social security contributions on the payment of salaries and other forms of remuneration to workers.

Personal income tax rates vary according to the level of salary paid. As a reference, the applicable withholding rates in Madeira for 2013 start at 1% (for a monthly income up to 590 euros, single individuals) to 44,5% (for a monthly salary over 25.000 euros, single individuals). Monthly salaries up to 585 euros are not subject to withholding personal income tax.

Social security contributions are of a fixed rate of 11% for the employee and of 23,75% for the employer. The social security rates applicable to Directors are of 21,25% paid by the company and 10% paid by the Director.

The amounts withheld will be paid to the tax authorities until the 20th day of the following month in which the deductions were made.

Minimum and average wages

In the year 2009, the average gross monthly wages paid in the Autonomous Region of Madeira in the services sector were of approximately 1.996,60 euros for highly qualified workers and of 775,50 euros for non-qualified workers. The minimum monthly wage set for 2013 in Madeira is of 494,70 euros.

Other related documents

Labour Law Overview

Witholding tax tables

Average monthly income

Madeira’s IBC Regime Extended Until 2033

Madeira’s IBC Regime Extended Until 2033

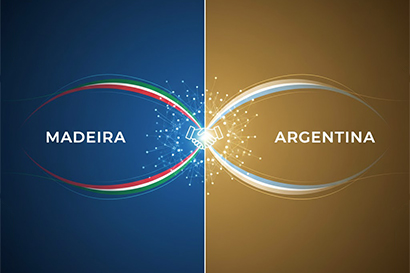

Argentine Ambassador to Portugal meets with SDM to learn about the Madeira's IBC

Argentine Ambassador to Portugal meets with SDM to learn about the Madeira's IBC

Madeira reinforces its strategic role in the European economy

Madeira reinforces its strategic role in the European economy

CEO of Madeira’s IBC Company Appointed European Cybersecurity Ambassador

CEO of Madeira’s IBC Company Appointed European Cybersecurity Ambassador

87 New Companies Registered in Madeira’s IBC in the First Half of the Year

87 New Companies Registered in Madeira’s IBC in the First Half of the Year

MAR Showcases Milestone at Premier Maritime Event in Norway

MAR Showcases Milestone at Premier Maritime Event in Norway